Is Japan in the tipping point?

How do we eliminate the obsession with "Tangible Asset (Hardware)"? Episode #24

Some of you who have subscribed to my newsletter may remember that I will establish my new company, GoGlobal Catalyst, in Singapore. This is my tenth company in life!

I haven’t talked to nor gotten an OK from my co-founder, Dan Brassington, but I’d like to start a Podcast as GGC with him. And I’ve composed a prologue song

for the GGC Podcast. Also, an epilogue song.

I hope everyone will like them.

Some might think I composed them myself, but I composed them using a music-creating AI called SUNO ;-)

My friend Nick Ashley sent me fascinating data about the difference in the tangible and intangible assets ratio between American and Japanese companies.

See the graphs below.

As the graph shows, 90% of the assets of S&P 500 companies in the US are “intangible assets,” whereas the intangible assets of Nikkei INDEX companies are only 32%.

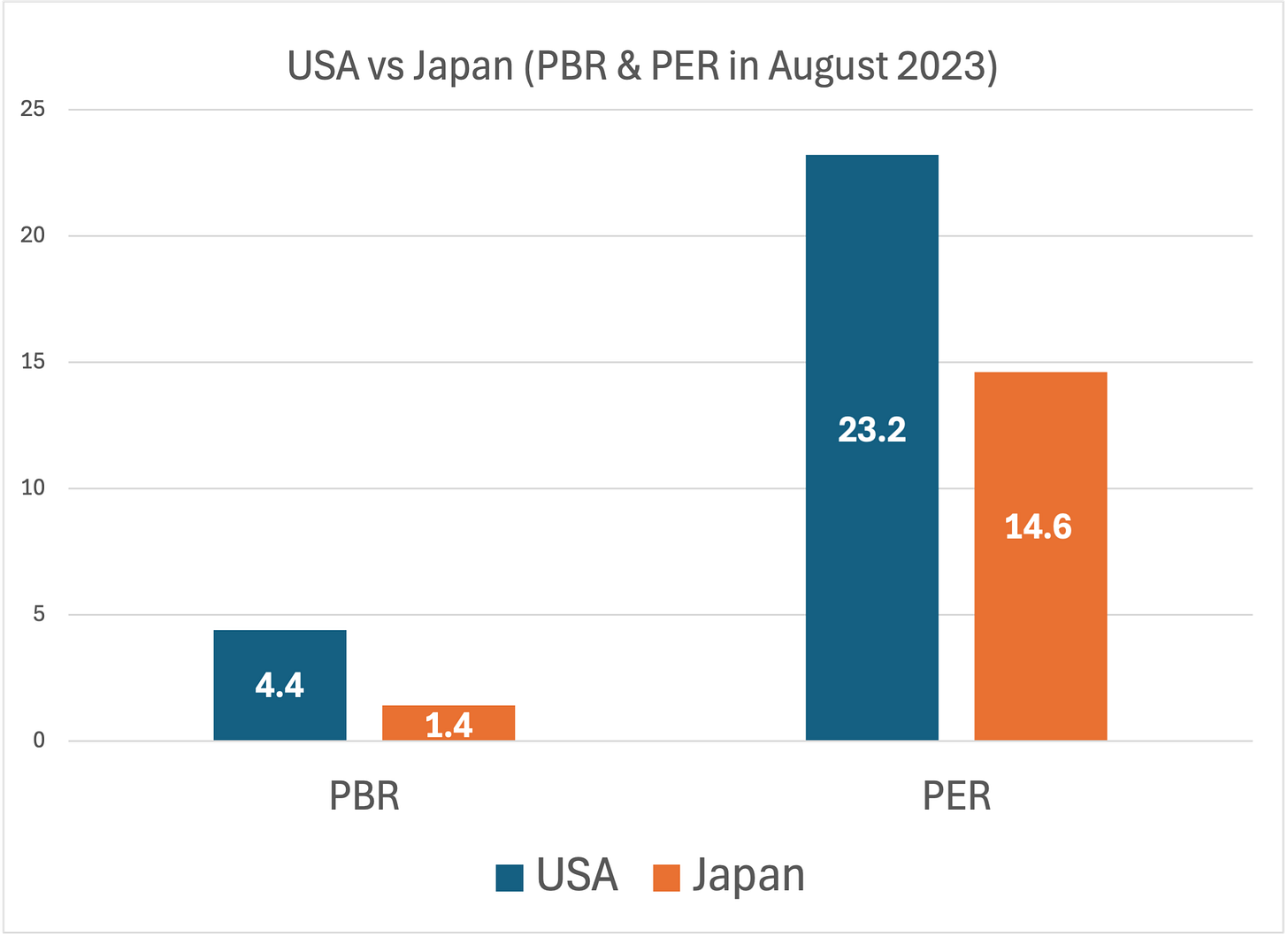

The next question is, how does the difference in the ratio of tangible and intangible assets held affect the PBR and PER of American and Japanese companies?

It is no exaggeration to say that the number of intangible assets is directly linked to PBR and PER.

Of course, some companies probably don't do this, but in general, I think that large Japanese companies are not good at making value judgments about “intangible assets.”

So, how about Japanese startups?

As I sometimes explained and introduced the startup ecosystem in Japan by Substack, it has grown dramatically in the quarter century since the Internet Bubble.

Back in the late 1990s, when I co-founded several startups, Webcrew, which went public in 2004, and Interscope, which was successfully acquired by Yahoo! Japan in 2007, the amount of money invested in startups was only about $1B a year.

However, it reached about $7B a year in 2022.

The most significant change is the dramatic increase in the number of science graduates from top Japanese universities like the University of Tokyo who aspire to start their own businesses after graduation.

When I was a student, the image of a student at the University of Tokyo was that of a nerdy, uncool guy wearing glasses as thick as the bottom of a milk bottle.

Today's students at the University of Tokyo are not only intelligent but also stylish and innovative, and they have many entrepreneurial talents!

This is a major reason why I have not given up hope for the future of Japan.

However, we need to change the mindset of startup founders and the regulations and system of the growth sector at the Tokyo Stock Exchange Market.

Simply put, we should stop startups that are listed with a small market capitalization and then do not raise funds but instead use their listing as a goal.

See the THREE graphs below.

On the other hand, there are some fascinating news!

Dinii, a startup that improves the management efficiency of the food service industry, has raised about $50M as a Series B finance from the Tier-1 VCs in Silicon Valley and New York.

Shortly after the Series B press release, Dinii founder Mao Yamada published a blog with scathing criticism of Japanese venture capitals. The blog was written in Japanese, but if you are interested, I recommend reading it by DeepL, Google Translate, ChatGPT, etc.

His blog post title is “Is there any value in Japanese VC gaming for single base hits?”

Finally, we at GoGlobal Catalyst are aiming for a smash hit on the level of Shohei Ohtani, of course!

We aim to produce global startups through the Co-founder matching program for Japanese and foreign founders and to launch our own startup! It's free to say and free to aim for!

Stay tuned!!