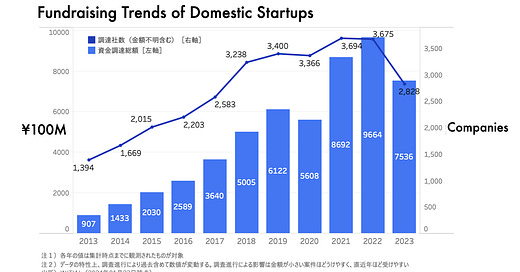

Fortunately or unfortunately, the startup ecosystem in Japan has been uncoupled from the world. Therefore, startup fundraising peaked in 2022, one or two years after Silicon Valley and Europe.

However, the magnitude was not as considerable as overseas, so the drop from 2022 was about only 22%.

While startup fundraising has declined, like the S&P 500 and NASDAQ, the Tokyo Stock Exchange market's Nikkei Index exceeded the bubble economy's highest price in the late 1990s after 35 years!

This is because it boosts the profits of large companies due to the exchange rate, meaning weak Japanese Yen, especially export-oriented manufacturers. It implies that the industrial fundamentals have not been restructured and innovated, at least from my point of view.

But, one exception should be addressed is that Tokyo Electron, a Leading Global Company that makes semiconductor manufacturing equipment, its market cap has increased significantly, as the chart shows

So, is such an environment of the Japanese market not a business opportunity for startups? The answer is “yes”. There are exciting opportunities.

As the title of this episode, except a few areas, especially the finance related industries, it’s outdated in Japan. But it presents a very unique business opportunity.

It’s a fintech startup called “GIGA,” and it is originally from Estonia.

As some of you know, there are language barriers in Japan for foreigners who live there—for example, opening their bank accounts. Because the absolute numbers of foreign people who live in Japan who need bank account used to be not so many, developing multi-lingual interface had not made sense from the Japanese financial service companies’ perspective, said, it didn’t pay.

However, in several decades, the numbers of foreign people who live in Japan have kept growing and the demands of the bank accounts keep increasing. However, developing the multi-lingual interface is still an issue for financial companies

The founder of GIGA, Raul Allikivi, has an experience of studying at Waseda Univrsity in Tokyo; long story short, he returned to Tokyo. Then, he realized that BIG demand for opening bank accounts in Japan is emerging. Still, most Japanese banks are unwilling to apply such demands due to the highly complicated system integration.

He worked for the financial-related ministry of the Estonian Government and has expertise in the industry. That’s why he could develop how to address the issues.

The idea is an intermediary between the foreigners and the Japanese banks.

Japanese banks do not have to develop the whole system, and GIGA helps them to provide banking services to their foreign customers. Foreigners can use their bank accounts in English and some other foreign languages.

He is now focusing on the Japanese market, but, of course, he would like to expand their business into Southeast Asian countries and some other markets.

If possible, I’d like to describe more details in the next episode based on the interview with him.

Stay tuned.